Health literacy is more important than ever as individuals now have the opportunity to shop for health benefits in health exchanges established under the Affordable Care Act. In order to make the right decision about their healthcare benefits, however—a decision that will affect them during the entire benefit year—individuals must understand common health benefit terms as well as services covered and their financial responsibilities. And yet, two alarming statistics make me wonder if we are ready:

Health literacy is more important than ever as individuals now have the opportunity to shop for health benefits in health exchanges established under the Affordable Care Act. In order to make the right decision about their healthcare benefits, however—a decision that will affect them during the entire benefit year—individuals must understand common health benefit terms as well as services covered and their financial responsibilities. And yet, two alarming statistics make me wonder if we are ready:

- According to a survey released in August by the American Institute of CPAs, many don’t understand key, basic facts about health insurance. The telephone survey of 1,008 U.S. adults, conducted by Harris Interactive, found that 51% could not accurately define at least one of three common terms: premium, deductible, and co-pay. [1. U.S. scores low on health-insurance literacy, August 28, 2013, 2:51 PM]

- Nine out of 10 workers say they typically choose the same plans (e.g., medical, dental, vision) year after year. Yet most employees don’t fully understand their policies, what is covered, and changes made each year.[2. Aflac: Avoiding Costly Mistakes During Open Enrollment, BY THOMAS R. GIDDENS OCTOBER 18, 2011] What many workers don’t realize is that the old selection may not be the best option.

[simplesidebar]Health literacy is: “The degree to which individuals have the capacity to obtain, process and understand basic health information and services needed to make appropriate health decisions.” Source: Healthy People 2010[/simplesidebar]

If people don’t understand common terms, how can they take on the responsibility of shopping for benefits on their own, where choice is abundant?

The launch of health insurance exchanges in less than a month brings the consumer a whole new experience of shopping for health benefits. In addition, many employer-based health benefits now include high-deductible health plans (HDHPs) as a new plan option, further increasing employee choice and confusion. With these changes and additional choice, it is even more important for individuals to be health-literate.

The cost of healthcare continues to be problematic for many organizations and impacts the livelihood of many individuals in one way or another. Employers are attempting to contain costs by increasing employee contributions or decreasing benefits. Healthcare reform leaves individuals questioning how they will be affected. If individuals cannot obtain, process, and understand basic health and benefits information, then how are they supposed to make appropriate decisions that will ultimately impact their health and wealth?

Of the 30 million newly insured Americans under the ACA:

- 32% will gain coverage from Medicaid

- 45% from the individual exchanges

- 23% from their employers

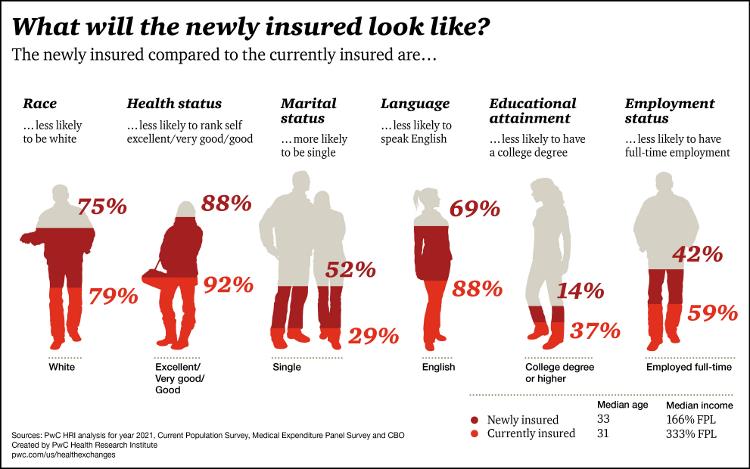

The newly insured will be less educated, more racially diverse, and more than twice as likely to speak a primary language other than English. [3. PWC 30 million newly-insured under the Affordable Care Act: Who are they?]

As we look at this new landscape—with particular focus on this fall and beyond—careful consideration is required no matter what your role is within healthcare. You’ll need to make sure that your benefits communication strategy, available decision-support tools, and health literacy efforts are aligned to help individuals make the right choice. And your consideration needs to include the population you serve, the changes you are making, and how individuals will be impacted financially.

Gone are the days of “passive enrollment” as employees become healthcare consumer. According to a news release issued by Aon Hewitt today, workers who plan to automatically default into the same health plan in which they were enrolled the previous year would be wise to rethink that strategy for the 2014 annual enrollment season.

Questions to ask your organization…

1. Have we implemented clear and concise communications and educational programs that inform employees about the upcoming changes and address their concerns?

Despite the approaching October 1 deadline, 69% of companies have not communicated changes in healthcare coverage to their employees.[4. Most Still in the Dark About Health Care Reform August 29, 2013 By: Dave Mielach, BusinessNewsDaily Writer] Several new coverage options and financial protections are now required of employer-sponsored plans, including:[5. About the Law, U.S. Department of Health & Human Services: http://www.hhs.gov/healthcare/rights/index.html]

- coverage must be extended to children up to the age of 26

- pre-existing conditions can no longer be denied health insurance

- certain preventive care is now covered by every plan

Does your population understand these changes?

2. Are we personalizing the information?

For example, as more employers make the switch to full replacement HDHPs, it’s more important than ever for employees to fully engage with open enrollment materials so that they understand how to use the plans. Engagement is critical to your success. And by materials, I mean having access to online, personalized tools and information that is tailored to eligible plans, specific to their family and health issues, and provides actionable guidance. These are the things that can support engagement. With the Internet dramatically changing how users find and consume information, are you leveraging online tools and social networks to drive greater engagement and benefit literacy?

3. Do we know what questions our employees are asking? And can we answer them?

- What plan is right for me (and my family)?

- How do I weigh all these different options against each other?

- What if I make the wrong choice?

- What am I actually getting with that plan (or what am I not getting)?

- How much will it really cost me?

- What if… I need to go to the ER? We are diagnosed with something bad? We get sick away from home?

- What has changed from last year?

- How do I know I’m not spending too much for a plan I don’t really need?

- Is there someone I can talk to?

- How stressful is this decision-making process going to be?

Are you doing enough to help your population “speak benefits”?

Helen Darling, NBGH president, makes it clear: “Workers know what they need to do to manage their health, but unfortunately that’s not enough. To turn this knowledge into positive actions, individuals need very specific tools, tactics, and motivation. As employers consider making changes to their healthcare benefits in response to healthcare reform, they have a great opportunity to revitalize their existing strategy and create programs that will promote workforce health and productivity and hold down overall healthcare costs.” [5. Hewitt, National Business Group on Health Survey Shows Most U.S. Workers Will Continue to Rely On Employer-Provided Health Benefits. May 24, 2010. http://www.businesswire.com/news/home/20100524005199/en/Hewitt-National-Business-Group-Health-Survey-Shows]

If you’re not sure you’re doing enough, please call us. We can help.